|

||||||||||

|

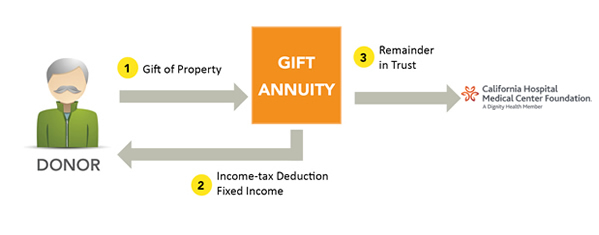

Charitable Gift Annuities

How it works

![]() You transfer cash or securities to California Hospital Medical Center Foundation.

You transfer cash or securities to California Hospital Medical Center Foundation.

![]() California Hospital Medical Center Foundation pays you, or up to two annuitants you name, fixed payments for life.

California Hospital Medical Center Foundation pays you, or up to two annuitants you name, fixed payments for life.

![]() The principal passes to California Hospital Medical Center Foundation when the contract ends.

The principal passes to California Hospital Medical Center Foundation when the contract ends.

Benefits

- You receive an immediate income-tax deduction for a portion of your gift.

- Your annuity payments are guaranteed for life, backed by California Hospital Medical Center Foundation's reserve and assets.

- Your annuity payments may be treated as part ordinary income, part capital-gains income (15 percent), and part tax-free income, depending on the assets used to fund the annuity.

- You can make a significant gift that benefits you now and California Hospital Medical Center Foundation later.

Consider a charitable gift annuity if you:

- Want to make a significant gift to California Hospital Medical Center Foundation and receive lifetime payments in return

- Are 65 years of age or older

- Want to maximize the payments you receive from your planned gift – and you want to lower your income tax on those payments

- Want the security of payment amounts that won't fluctuate during your lifetime

- Appreciate the safety of your payments being a general financial obligation of the institution

Related Links

More about charitable gift annuities

Gift example

Deferred charitable gift annuity

Charitable Gift Annuity Rates – As of January 1, 2012

For assistance with this gift plan, please complete the request information form or contact Susan Shum at (213) 742-5662 or email to susan.shum@dignityhealth.org